NEW ZEALAND and Australian businesses are trailing behind their global counterparts with only 17 percent of businesses digitally mature enough to build disruptive business models at scale compared to a global cohort of 22 percent. That is one of the key takeaways from research undertaken by Infosys (NYSE: INFY), a global leader in consulting, technology, and next-generation services.

The research report released last month - Infosys Digital Acceleration Study: Australia and New Zealand Report – polled 175 senior business decision makers from the region’s biggest companies, each with a revenue of over $1 billion, to better understand where Australia and New Zealand’s largest enterprises are in their digital transformation journey and what they require to accelerate that journey.

The survey of Senior IT decision-makers reveals that enterprise leaders across sectors are at varying stages of digital agility, while facing consistent barriers and opportunities to building disruptive business models at scale.

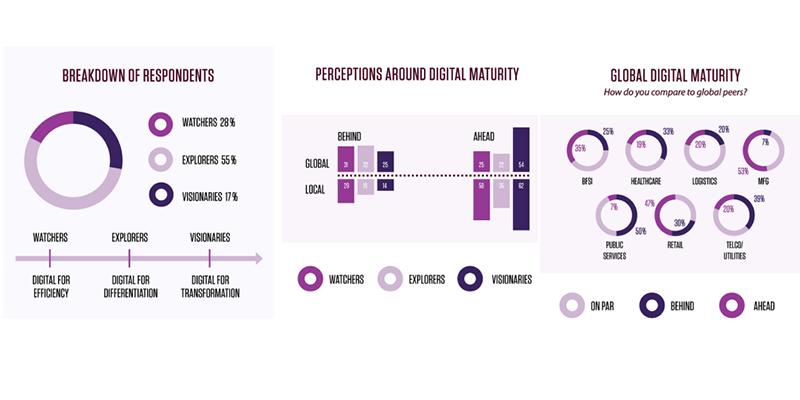

The report identifies three clusters based on digital maturity:

• Visionaries – Transform to meet business objectives through new business models and an innovative culture. They understand digital is central to the success of future endeavors

• Explorers – Committed to improving their customer’s experiences. Identify with digital programs that enhance customer experience, or increase brand value through differentiation

• Watchers – Largely focused on efficiencydriven outcomes of digital adoption

Approximately 17 percent of respondents are identified as visionaries, in contrast with 22 percent of their global counterparts, indicating that fewer Australasian leaders have identified digital transformation as a central part of their business strategy in comparison to global peers.

The majority of businesses surveyed (55 percent) fall into the Explorers category, with a focus on digital transformation for the differentiation value it gives them in either customer experience or an uplift in brand value. This is higher in comparison to global peers of whom 50 percent are categorised as Explorers.

Additionally, 28 percent of New Zealand and Australian respondents are identified as Watchers which is on par with global research. Watchers have partially deployed digital initiatives but are focused on efficiency-driven outcomes.

Common to all groups of business leaders is an understanding that business agility (85 percent), enhancing digital culture (82 percent), and delivering seamless customer experience (78 percent) are key organisational drivers to enable them to build disruptive business models at scale.

Visionaries particularly recognise that there is a constant need to reinvent themselves to stay relevant to their customers. Andrew Groth, Senior Vice President and Regional Head Australia and New Zealand, Infosys said that digital transformation is a process of constant reinvention, where businesses must implement disruptive models that create agility in constantly driving new experiences for the customers at scale.

“This research illuminates how businesses can successfully move forward in the journey to digitally accelerate, to leverage the opportunities available to better operate in a digitally-driven market at significant scale.

Over the years, large businesses within the region are progressing along different digital transformation journeys with varying levels of maturity. We can see a massive opportunity for businesses in the region to leverage digital and disruptive technologies with speed, and also use learnings from some of the more mature global peers from their digital transformation journeys.

“Organisations are facing the challenge of bringing disruptive products and solutions to market, despite having a clear vision and strategy for their digitization journeys.

What our research uncovers is that a large number of organisations are encumbered by rigid technology, the digital skills gap and more importantly a culture gap that stifles innovation, which is key to achieving a digitisation vision. This is ultimately resulting in businesses being unable to create the customer experience and competitive advantage at speed, eventually losing the mindshare with their customers.”

CREATING AN ENVIRONMENT CONDUCIVE TO DIGITAL MATURITY A SIGNIFICANT CHALLENGE

Interestingly, internal challenges rather than external market forces are cited as a major barrier to change with resourcing and legacy issues preventing organisations from making rapid progress. Organisational silos (38 percent) and transforming from a low risk organisation to an organisation that rewards experimentation (37 percent) are some of the most prevalent challenges cited by businesses, as well as hiring digital natives and building digital skillsets (38 percent).

Groth said that what is apparent in this research is that business leaders know what they need, but often underestimate the full impact of digital transformation once you dig deeper.

“There is a skewed view of digital transformation, with 67 percent of respondents having a clear outlook on opportunities, and a considerably lower 50 percent having a clear understanding on threats. Interestingly, as businesses move to becoming digitally mature, there is a correlation between maturity and higher risk awareness, but we have some way to go in this market.”

GLOBAL COUNTERPARTS ARE LEADING TRANSFOR MATION, DIFFERING VASTLY PER SECTOR

Despite 72 percent of respondents identifying as belonging in the visionary and explorer cluster, there is an overall sentiment amongst enterprise business leaders that their digital transformation journeys are not comparable at an international level. When comparing themselves to global clusters respectively, slightly over half (54 percent) of visionaries perceive themselves to be globally ahead, while only 22 percent of explorers and a quarter of watchers (25 percent) feel globally ahead of peers. When compared to local counterparts, this perception is higher, with 62 percent of visionaries, 35 percent of explorers and half (50 percent) of watchers feeling ahead amongst their peers.

The survey has also revealed industries such as the public sector, healthcare and utilities report feeling most behind global counterparts, while logistics and manufacturing are the most confident. Half of public service organisations (50 percent) feel their digital maturity is behind global peers, with only 7 percent reporting being ahead. Healthcare and telecommunications/utilities both report only 19-20 percent maturity. The retail industry reports a split, with 30 percent of respondents feeling behind, and 47 percent of respondents reporting maturity. Both logistics and manufacturing organisations feel comfortable, with 80 percent and 93 percent respectively reporting digital maturity on par or ahead of global counterparts.

A FULL COPY OF THE REPORT IS HERE: WWW.INFOSYS.COM/NAVIGATE-YOUR-NEXT/RESEARCH/AUSNZ