The global steel industry is navigating a pivotal and capital-intensive transition towards decarbonisation. While technological innovation in hydrogen-based and electric ironmaking remains critical, the focus has sharpened on the demand-side dynamics that make this transformation financially viable. Proactive offtakers in key sectors like automotive and construction are moving beyond passive procurement to actively shape the market, providing the bankability required to build the green steel plants of the future.

This article is based on research from IDTechEx's "Green Steel 2025-2035: Technologies, Players, Markets, Forecasts” report, which provides in-depth analysis of this evolving landscape, revealing how purchase commitments, coupled with policy and finance, are stimulating the green steel market.

Why early adoption by offtakers is crucial for decarbonisation

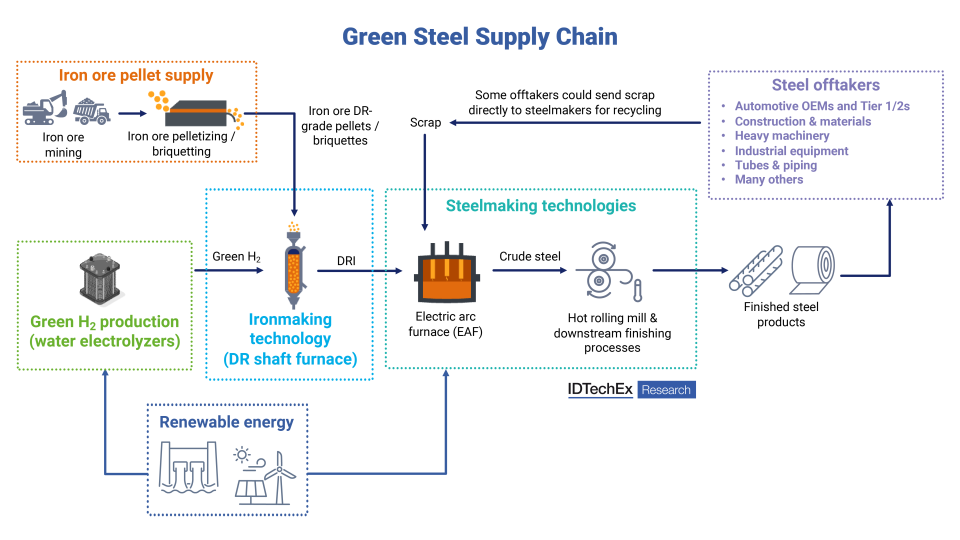

The shift from carbon-intensive blast furnaces to greener alternatives, such as hydrogen-based direct reduced iron (H2-DRI) coupled with electric arc furnaces (EAFs), requires immense upfront investment, with individual projects often costing billions of dollars. For these projects to move from announcement to reality, producers need to secure long-term revenue certainty.

This is where offtakers play a fundamental role. Through binding, long-term offtake agreements, major steel consumers commit to purchasing future volumes of green steel, often at a premium to conventional steel. These agreements are the financial bedrock of the green steel transition. They significantly de-risk investments for producers and are a critical prerequisite for securing the necessary project financing from private investors and financial institutions. As detailed in IDTechEx’s report, the success of emerging players like Stegra (H2 Green Steel), which has raised over €6.5 billion, is directly linked to its ability to pre-sell more than half of its initial capacity through such contracts.

Key drivers: a convergence of policy and corporate strategy

The growing demand for green steel is propelled by the convergence of regulations and ambitious corporate climate strategies. On the policy front, frameworks like the EU’s Emissions Trading System (ETS) and the Carbon Border Adjustment Mechanism (CBAM) are increasing the cost of carbon-intensive production, creating an economic case for low-carbon steel. The CBAM is notable as it aims to prevent the offshoring of production to other countries with looser regulations, thus reducing the risk of carbon leakage. Steel producers in China are already aligning to comply with the CBAM. Furthermore, EU regulations like the End-of-Life Vehicles (ELV) Regulation and the ESPR may also stimulate demand for green steel.

In parallel, corporations are facing mounting pressure from investors and consumers to decarbonize their entire value chains, particularly their Scope 3 emissions, which include purchased materials. For an automaker or construction firm, steel constitutes a substantial portion of this embodied carbon. Committing to green steel offtake is one of the most direct and impactful ways for these companies to meet their net-zero targets.

Key player activities: automotive leads, other sectors follow

The automotive sector has emerged as the clear driving force in the offtaker movement. The willingness to absorb a “green premium” is driven by the fact that even a significant per-tonne cost increase for steel translates to a marginal (1-2%) increase in the final vehicle price. This allows automakers to boost their sustainability credentials with minimal consumer-facing cost impact.

European OEMs, as well as Tier 1 and 2 suppliers, are actively procuring green steel. For example, the Swedish startup Stegra (H2 Green Steel) has successfully secured offtake agreements with a roster of automotive leaders including Mercedes-Benz, Porsche, Scania, and ZF. Likewise, SSAB, a pioneer with its HYBRIT fossil-free steel project, has established partnerships with the Volvo Group. Established steelmaking giants are also making significant moves – ArcelorMittal is supplying its XCarb® recycled and renewably produced steel to General Motors, signaling growing momentum for green steel in North America.

While automotive captures the headlines, demand is broadening. In the construction sector, Stegra (H2 Green Steel) has secured agreements with building solutions provider Kingspan and ventilation firm Lindab. A compelling circular economy model is also emerging in the energy sector, where utility Vattenfall is set to purchase fossil-free steel from its HYBRIT project partner SSAB for use in its own energy infrastructure. Machinery and industrial equipment manufacturers like JCB, Alfa Laval, and Lindab are also interested in procuring steel for their products. Interestingly, even Amazon Web Services (AWS) has used recycled steel for data centre construction in Sweden.

Outlook: a market forged by demand but facing headwinds

The path forward is defined by both immense opportunity and significant challenges. While offtaker demand, government subsidies, and green finance create a powerful ecosystem, the supply side remains fragile. Offtakers must navigate the risks of a nascent market, including potential project delays, price volatility linked to renewable energy costs, and a lack of universally accepted standards for what constitutes “green steel”, which creates a risk of greenwashing.

The structure of the industry itself may be set to transform. The concept of “green iron hubs” is gaining traction, where iron is produced using green hydrogen in regions with abundant renewable energy (e.g., Australia, Brazil) and then shipped as hot briquetted iron (HBI) to steelmakers elsewhere. This decoupling of iron and steel production could reshape global supply chains.

Despite these complexities, the trajectory is clear. The demand signal from offtakers has begun the industry’s gradual transition. The future of steel depends not only on the furnaces used to make it but also in the long-term contracts signed by forward-looking consumers.

IDTechEx forecasts that hydrogen-based green steel production will reach a significant 46 million tonnes by 2035. While this is still a fraction of the total required to meet 2050 net-zero targets, it represents a definitive start. For a more detailed analysis of the technologies, market dynamics, key player activities, and granular 10-year forecasts shaping the transition to low-carbon steel, please refer to the report, “Green Steel 2025-2035: Technologies, Players, Markets, Forecasts”.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/GreenSteel, or for the full portfolio of decarbonization research available from IDTechEx, see www.IDTechEx.com/Research/Energy.